By Neel Shah and Rishi Shah

Gender Pay Gap - Rishi

The latest government legislation stated that, “If you are an employer with 250 employees or more, you will need to publish your annual gender pay data.” This has led to 400 firms reporting on their pay gaps in the last week and 7,000 companies still to report.

Frankly, the figures have been shocking and here is a quick round-up of some of the largest firms.

• Goldman Sachs: A median UK gender pay gap at its international business of 36.4% for hourly pay and a median bonus gap of 67.7%.

• HSBC: Men are paid two and a half times more per hour than women on average.

• Guardian: A mean gender pay gap of 11.3%

• PwC: A mean gender pay gap of 43.8% and a median gap of 18.7%.

These figures are sending shockwaves through the nation, with men and women alike feeling outrage, and the large firms scrambling to fix this. The main cause of this is not that there is a lack of women in the services that are highest paying. There are in fact more women working in financial services than men. Instead, it is the fact that women are over-represented in the lower-paying roles, and rarely get promoted to the senior roles. This discriminatory act has led to a male-majority in the highest paying roles in a firm and female-majority in the lower end.

Although many believe that not enough is being done, whilst that may still be true, we have seen some progress over the years. A campaign was launched in 2010 for FTSE 100 companies to have a minimum of 30% women on their boards. At the time figure was 12.5 percent, it now it is at 27.9 percent. This is a positive sign of progress, and after all the figures of pay gaps are revealed, we await a huge revolution to bring about equal pay.

Prudential split: Insurance reformed? - Neel

Prudential PLC is a British multinational insurance and finance giant, headquartered in London. Prudential has announced that it plans to split the company into two operations, splitting UK business (which is relatively slow in growth) from US-Asia operations. This is the biggest overhaul in the company’s 170 years of existence and is part of a specialisation campaign in insurance (which is dominated by low interest rates and regulatory change).

This will create two new companies: Prudential plc (home to US, Asian and African business) and M&G Prudential (asset management and UK insurance). Both companies are predicted to be in FTSE 100 and on several stock exchanges around the world (such as London, New York and Hong Kong). This is expected to rise share prices, with Prudential shares having risen by 6% when the split was announced.

Time for a break up? - Rishi

The Chief Executive of the Financial Reporting Council, Stephen Haddril, hinted at the break up of the Big Four accounting firms. EY, PwC, KPMG and Deloitte, have been regularly in the news recently for all the wrong reasons. The break up of them could boost competition in this market and therefore potentially eliminate all conflict of interests that often occur. For example, KPMG has been in the news regarding the Carillion case and is now under investigation on the collapse of the firm. There have been talks with the CMA to possibly open an investigation into the exploitive nature of the Big Four. They all have a responsibility to serve the public and private firms fairly, and frankly, it doesn’t seem like they are currently successfully doing that.

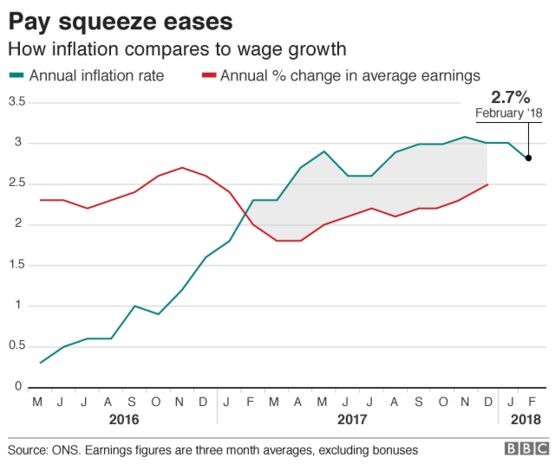

End of the squeeze on households? - Neel

Inflation in the UK dropped to 2.7% in February, the lowest rate since July 2017. This suggests the ‘squeeze on households’(1) may be ending, especially considering that the Bank of England forecasts wages to grow quicker than inflation later this year. This has eased pressure on the Bank of England to raise interest rates (as a contraction in monetary policy – i.e. a rise in interest rates – will slow economic growth despite easing inflation).

The fall in inflation is partially due to a fall in petrol prices, with petrol prices falling by 0.2p per litre and diesel prices falling by 0.1p per litre. In addition, food prices also saw a small rise in price of only 0.1% (compared to a staggering 0.8% last year). However, the sector that saw the greatest rise in prices was clothing and footwear, with women’s shoes rising by 1.7%.

Despite this, it is important to note that the fall in inflation may not last long, particularly due to the uncertainty surrounding the Brexit deal, in addition to other major events.

(1) The ‘squeeze on households’ refers to the principle that household income is rising slower than inflation, thus households can afford fewer goods and services.